– News and commentary from Quincy Quarry News.

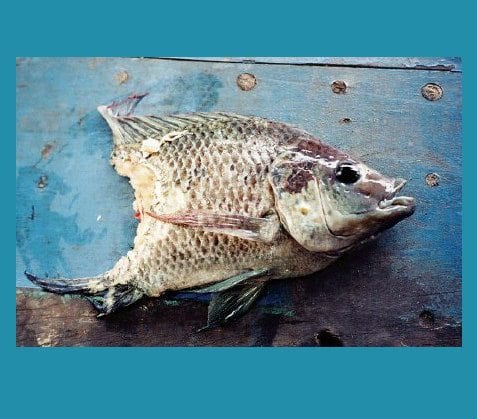

Quincy Quarry Weekly Fish Wrap: Time for leftovers …

This past week’s news had its ups and downs.

At the same time, however, most of the breaking news broke badly – if not also was stale – upon whom the news broke no matter from which direction it came.

For example, complaints continue to pile up on politicians doing things they shouldn’t be doing, most especially untoward actions towards unappreciative as well as sometimes even unconscious females.

And as for another up, Quincy’s now lame duck but still for a while longer Number One Ward Heeler headed up north to Alaska for a frozen vacation over Thanksgiving, if not also a from frozen Thanksgiving Turkey dinner.

That and to get outta Dodge after this month’s local elections did not go as planned.

Any perceived impact as regards climate change, however, is surely but coincidental.

At least those hoping for a White Christmas had better hope so.

Also going up are waist lines as well as Lipitor® sales following the Great American Eat Out, better known as Thanksgiving.

As for going down, however, local residential property tax bills are not likely to be heading down anytime soon.

Not only are the likely to be painful for many 2018 tax rates going to be announced within ten days, Quincy Mayor Thomas P. Koch has yet again reiterated his opposition to Monday’s passage of a city council local petition to seek Beacon Hill’s approval of a split as well as higher property tax rate imposed upon larger local apartment buildings.

So what, apparently, for the fact that this tax proposal would finally provide some property tax relief to long overburdened local homeowners who have also long been stuck picking up the checks on Mayor Koch’s profligate spending habits.

Besides the obvious reason of not wishing to make his rich friends and often considerable benefactors angry, apparently Mayor Koch does not truly appreciate how property assessment value increases on large buildings tend to lag, if not greatly lag, given limited and all but invariably lagging comparable sales data for many unit large apartment complexes to use to benchmark their property value assessments whereas, conversely, single family home property tax assessments have soared each and every year in recent years.

Then again, maybe he does.

]]>