– Quincy News from Quincy Quarry News with commentary added.

Quincy Quarry Weekly Fish Wrap: Budgets happen.

Earlier this week, the Quincy City Council approved Mayor Koch’s $340 million Fiscal Year 2021 budget.

The spending increase from Fiscal Year 2021 budget is 3.4% and thus likely to be greater than the rate of inflation even though the budget does not include any cost of living pay increases allocations in spite of the fact that all current city union employee labor contracts are expiring.

In turn, when only to be expected pay increases happen given city employees’ expectations of better pay days in the wake of their expiring lean five year union contracts are to be duly budgeted and then largely funded via local property taxes remains to be seen.

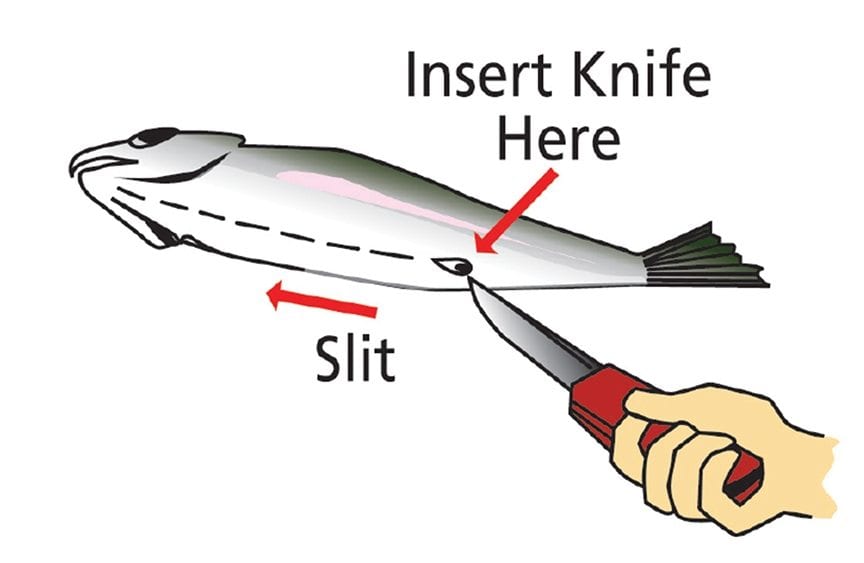

Then again, the Koch Machine has long practiced Koch and mirrors when it comes to its creative and often remiss presentations of the city’s books.

For example, how the Koch Maladministration has touted that its response to the Coronavirus pandemic it cut its original plans for a 6.4%/$20 million spending increase for its FY 2021 budget from its FY 2020 budget.

At the same time, The Koch Machine so yet again promulgated an at best partial truth.

Specifically, the maladministration tap danced around the likelihood of a conservatively projected by Quincy Quincy’s Financial and Other Sorts of Sordid Affairs Desk that an additional $10 million in revenue will need to be sourced somehow or other to cover anticipated Coronavirus-fueled cuts in state aid, offset cratering local excise tax local hotel/motel/tex revenue, bailout the still foundering Quincy College given its defaulting on a $2.4 million payment due the City of Quincy, fund the aforementioned only to be expected pay increases, and a few other items.

In other words, the total nut that will need to be covered via the local property tax revenue looks to be pretty much same as what would have been the case if COVID-19 had not hit the fan and the mayor’s original outsized 6.4%/$20 million spending increase for Fiscal Year 2021 instead happened.

That and a purported frugal FY 2021 budget notwithstanding, Mayor Koch has promised level local services during FY 2021.

In other words, alchemy.

Then again, seeing some less than hard-working favored employees actually putting in something sorta/kinda approximating a full day of actually working on the job on taxpayers’ behalf, stop taking care of their honey do list assignments and/or cease putting in time on their side gigs while supposedly at their day jobs, level services could conceivably happen.

That and pigs flying in ways other than in a cargo hold.

“Pay no attention to the man behind the curtain”

A Facebook photo

Conversely, other Massachusetts municipalities have been aggressively trimming their spending wherever possible as well as handing out layoff notices to those low on the seniority totem poles to provide them with proper notice of their likely severance.

In short, come December’s setting of local property tax rates, count on the Team Koch to be blaming Coronavirus 24/7 for what Quincy Quarry expects will be ugly property tax increases for local homeowners in 2021.

After all, nothing is ever Quincy’s peerless mayor’s fault.

So what for the fact of Mayor Koch’s long-ongoing free spending ways with tax dollar sourced funds, his past drainings down of the level of the City of Quincy’s rainy day reserves to perilous levels, his more recent failures to replenish the city’s Stabilization Fund at rates anywhere close to duly matching up with his rate of annual spending increases – much less duly fund it up to a level anywhere close to the best practices range of 8% to 10% of annual spending.

Then again, a once in a century pandemic makes for a disingenuous all-inclusive excuse for failing to put away an appropriate amount of actually available money away to tap on a rainy day to help moderate the pain for taxpayers when things do hit the fan.

QuincyQuarry.com

Quincy News, news about Quincy, MA - Breaking News - Opinion

No more posts