<![CDATA[

– News about elsewhere covered by Quincy Quarry News with commentary added.

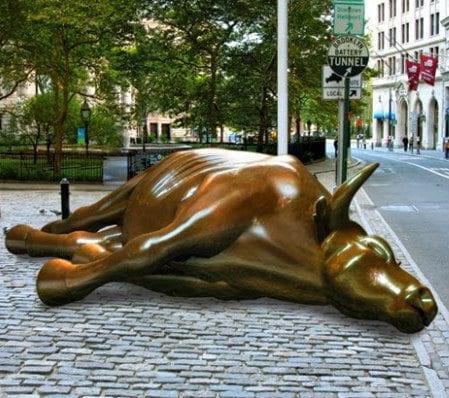

A powerful signal of impending recession has Wall Street’s attention.

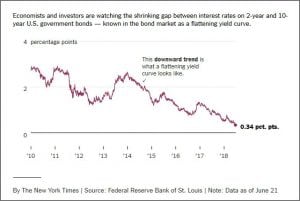

The bond market’s yield curve is perilously close to predicting a recession — something the yield curve has done with surprising accuracy over the years — and something which has become a big topic of concern on Wall Street.

Specifically, the concern is that short term interest rates are going up while longer term rates are not.

Every recession that has occurred during the past 60 years has been preceded by an inverted yield curve – which means when short term rates are higher than longer term rate – according to research from the San Francisco Federal Reserve Bank.

Yield curve inversions have “correctly signaled all nine recessions since 1955 and had only one false positive, in the mid-1960s, when an inversion was followed by an economic slowdown but not an official recession,” the San Francisco bank’s researchers wrote in March.

Read all about it and learn at: What’s the Yield Curve? ‘A Powerful Signal of Recessions’ Has Wall Street’s Attention

]]>