Image via LinkedIn

Quincy Massachusetts News, Opinion, and Commentary by Quincy Quarry News

In what was hard to believe as anything other than an all but certain brazen attempt to avoid advising local homeowners what to expect in the way of property tax bill increases come the start of 2025, the Chairman of the City of Quincy Board of Assessors, the City of Quincy Director of Municipal Finance, and the Quincy City Council all failed to provide word as to what Quincy homeowners should expect in the way of impending property bill increases during the December 2 tax classification City Council meeting.

So what, apparently, that such information has typically been provided during prior years’ tax classification city council meetings so as to only properly advise local homeowners of what to expect in the way property tax bill increases for the coming calendar year.

Instead, all manner of vapid PowerPoint overhead projections were shoveled upon council meeting attendees and those watching the meeting streamed live via Quincy Access Television as well as a similarly all but useless fancy printed handout was made available that addressed all manner of often arguable trivia without ever mentioning how hard a shot to gut will be residential 2025 property tax increases.

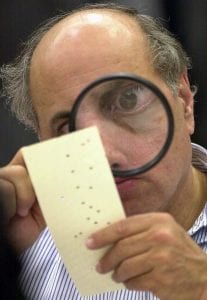

Fortunately for Quincy Quarry News’ ever-growing legions of loyal readers, Quincy Quarry News personnel tasked to cover the council meeting spotted essential data quickly shown during the overhead dog and pony show presentation that allowed for the Quarry’s financial and other affairs quants to interpolate what local homeowners should anticipate in the way of increases on their property tax bills come the New Year.

The Quarry also so scooped the South Shore broadsheet, not to mention that so far the local weekly tabloid does not appear to have reported as to what local homeowners should expect in the way of increases to impending their 2025 property tax bills.

In any event, per the Quarry quants local homeowners should expect an increase of 4.61% or thereabouts on their property tax bills on average given that homeowners’ assessed values can vary given recent comparable sales in their respective neighborhoods.

So what, apparently, for the fact that the final duly adjusted FY 2025 budget spending increase was only 3.51% after a $4.2 million spending cut was approved at Monday’s city council upon the approved last June $9,142,431.00 appropriation for budget line item 570900.

Needless to say, no compelling explanation was provided as to how budget line item 570900 turned out to be over-budgeted last spring by 85%.

In any event, the median assessed value homeowner should expect to see a $320.48 increase upon last year’s.$6,944.57 tax bill and so totaling $7,265.05 come the New Year.

Granted, the average impending 4.61% property tax increase for homeowners is less than this year’s over 8% on average increase, an increase Quincy Quarry accurately projected well in advance of the yet to be officially becoming known, the Quarry is again reiterating its preliminary expectation of an 8% plus increase in homeowners’ property tax bills come 2026.

This expected second 8%-plus residential property tax increase in three years is fueled in no small way by the fact that City of Quincy debt service expense in FY 2026 is looking to soar by roughly 50% from FY 2025’s $65,938,452.00 to upwards of $100 million.

“There’s nothing for you to see here …”

A Paramount Productions image

The primary reason for the expected stupendous increase in city debt service expense in FY 2026?

Quincy Mayor Thomas P. Koch’s delaying for three years the commencement of paying down principle on his $475 million pension obligation bond issuance that bailed out a woefully underfunded city employee pension fund at local taxpayers’ expense.

Most painfully expensive in the grand scheme of things.

(Monkey) Business as usual in the Q …

Image via joshpodek.com

So what, apparently, for the fact that the city employee pension fund is supposed to be fully self-funded via city employee paycheck deductions.

In other words, Mayor Koch both stuck local taxpayers’ with bailing out the city employees’ pension fund while also kicking the cost can down the road for several years and so also increased the total cost of paying down the $475 million pension fund bailout bond issuance.

That and a bit more in other increased debt expenses care of Mayor Koch;s continuing to spare no expense on his various pet projects at local taxpayers’ expense.

Invariably painful expense.

And as for further insults of local taxpayers, an especially snippy City Council President Ian Cain even for him regularly cut the mike at the podium set up for locals to express themselves during the public hearing aspect of last Monday night’s tax classification rate setting council meeting.

So much for the once self-proclaimed libertarian and now crypto Republican enabling Free Speech …

“Patriotism is the last refuge of scoundrels”

A file photo

Cain then followed up the next morning with a shoveling of fanciful kayfabe via a podcast interview streamed by Quincy Access Television that was rife with all manner of vague numbers posed that did not add up, much less line up with reality.

Then again, what else could one reasonably expect from Quincy’s biggest loser in last September’s primary elections?