A Quincy Quarry News file photo image

Quincy Massachusetts News, Opinion, and Commentary by Quincy Quarry News

Last night’s Quincy City Council meeting became contentious and then some when local mostly homeowners spoke up at one of the very few times during a year when the public is allowed to offer up comment on the record during Quincy City Council public hearings.

The main event at last night’s public hearing was to set the tax rate classification and which is the opening step for Quincy elected officials to then set property tax rates for the upcoming new calendar year.

Accordingly, a number of residents endeavored to pose their travails given soaring property tax bills on their homes in recent years.

Soaring by as much as 18% in 2024 said some.

In turn, on a number of occasions City Council President Ian Cain summarily turned of the microphone set up at the podium for locals to offer public comment on the record as well as that Cain was often also snippy and worse with those expressing their financial pain given soaring property tax bills.

Inexcusably snippy.

Further inexcusable, part and parcel to the annual tax rate classification hearing is providing a reasonable sense of what local homeowners can expect to see in the way of increases in their property tax bills come the start of 2025, however, such information was not provided.

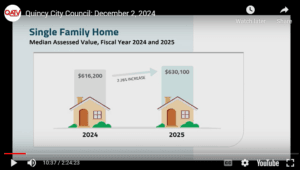

The bad news: property tax bills would appear to be increasing by just short of 5% on average and so on the high end of the range that Quincy Quarry News predicted weeks ago.

Granted, the Quincy Quarry News’ interpolated average 4.61% single family residential tax increase on the median value single family residence in 2025, ceteris paribus, will be less than the average over 8% property tax increase imposed on homeowners locally in 2024.

At the same time, 4.61% tax increase is still an outsized increase in the context of Prop 2 1/2 supposedly holding the total local property annual tax levy increase to 2 1/2% annually plus “New Growth”.

That and how on an identical assessed value bases Quincy homeowners have traditionally paid 10% to 20% higher property tax bills than Braintree and Weymouth homeowners.

Similarly, the median assessed value homeowner in Quincy pays over twice as much as a Boston homeowner pays on the same assessed value property as well as the no matter what is the dollar amount of a Boston residence’s assessed value, a similarly assessed property in Quincy faces a higher to much higher property tax bill.

Further problematic, the City of Quincy’s annual debt service expense is already on track to increase by upwards of 50% in Fiscal Year 2026 care of seriously koched-up debt issuances and thus the city’s debt expense next year will be leaning on $100 million given additional debt issuances variously in the works.

Concurrently, in FY 2026 City of Quincy debt expense will so run roughly 20% of the FY 2026 budget and which is considered to likely to give rise to potential problems for the City of Quincy’s credit rating, problems at least alluded to in the city’s most recent credit rating.

Further yet problematic, such a dramatic increase in debt service will likely fuel an average residential property tax increase in Calendar Year 2026 on the order of 2024’s over 8% increase.

Even more disconcerting, various other serious debt issuance commitments already made as well as anticipated will result in Quincy homeowners continuing to face painful property tax increases given the City’s metastasizing nine figure debt expense burden for most of the rest of the 2020’s, if not also continuing into the 2030’s.

Like a cancer, New Growth seems to be limited to the Lord Mayor and the rubber-stampers on the City Council. Koch and most of them, are self-servers rather than public servants. Vote them out!

Councilor Cain neglected to gavel the public hearing closed. Instead he moved into the council business. If someone chooses to challenge the lack of legally closing the hearing last nights vote on the classification could be void.

Sad to watch how the council treats the taxpayers and need to listen to councilor Devine tell the public what a good job he feels he and the others do. What an insult from the Granite Links poster boy, the silent voice of ward four.

Jack,

Lock, load, aim, and fire at will Gridley.

Imagine the fun if the MA AG were to invalidate the council’s setting of the 2025 tax rates. Just Cain’s repeatedly turning off of the mike alone …

https://www.needhamma.gov/4461/Complaint-Procedure

Jack,

A follow-up: the latest unpaid and overworked Quincy Quarry News intern goggled up word that the Quincy City Council is already known to Attorney General’s Open Meeting Law compliance unit for Open Meeting Law compliance shortcomings!!!

Just be sure to note you have a short time limit to submit a complaint to city officials before you might then duly reach out to the AG if city officials ignore you per their SOP. https://www.patriotledger.com/story/news/2017/01/26/quincy-city-council-faces-open/22540383007/

Cain doesn’t even want to be here. He has his sights on something else, something more grandiose, and that diminishes his role as a representative of the people in his ward and the City in general. So he gets irritated with the people who pay his overblown salary.

Asterisk,

True, but Ian’s distant third place finish in a three candidate GOP US Senate primary three months ago didn’t trim his overblown ambition even but merely one whit.

Oh, Quincy City Council meetings never fail to deliver drama worthy of a Netflix miniseries! The latest episode, “Council President Meltdown: Property Tax Edition,” gave us everything: raised voices, eye rolls, and enough “testiness” to make Gordon Ramsay look like a yoga instructor.

You’d think a discussion about property tax rates would involve, I don’t know, some facts, figures, and maybe—wild idea—a smidge of decorum? Instead, we got Council President [Insert Name Here] channeling their inner middle school debate team captain, snapping at colleagues and turning what should’ve been a discussion about our money into a theatrical performance. Spoiler alert: the taxpayers are still the ones left holding the bag.

If this is what “leadership” looks like, I’d hate to see a full-blown crisis. Maybe next time, we can skip the grandstanding and focus on what matters—like figuring out why Quincy’s property taxes always feel like an Olympic high jump. Or at the very least, let us bring popcorn to the next meeting.

Why does everyone still vote for Koch.

Let’s add DiBona, Harris, Devine and McCarthy. All of these Koch stooges have had opponents and yet they still have been re-elected. I get the feeling next year there will be many new challengers who will oppose current council members who put their greed and loyalty to Koch over local taxpayers. The outrageous raises and tax increases have put the voters over the edge.

No offense Jack, but councillors Ash, Cain, Campbell, and Liang haven’t been profiles in courage. Only rookie ward councillor Minton has pushed back on the now apparently found to be illegal raises per the State Ethics Commission. I can’t speak for you, but I can’t wait to see what sort of sanctions are imposed on the Mayor Koch and his eight tools on stools..

Marie S – Everyone votes for Koch because since first being voted in as Mayor, he promised that all of this development of condominium and apartment buildings would increase the total value of real estate subject to Real Estate Taxes thus providing relief to property owners at that time by reducing their Real Estate Tax bills.

You can see how well Mayor Koch’s plan has worked when you open up your next Real Estate Tax that comes in the mail.

Go ahead and calculate how much the property bill on your home has been reduced since Mayor Koch was elected Quincy’s de facto Chief Financial Officer and Chief Executive Officer.

Oh — you did this suggested calculation and found that your residential property tax bills did not decrease as promised? Well, the money has to come from somewhere to make sure our Mayor’s developer friends get even richer.

To answer your question, Quincy voters keep voting in a misguided fashion because they are not informed or do not become informed of our city’s management.