Image via Canva

— Quincy Massachusetts News by Quincy Quarry News – News, Opinion and Commentary

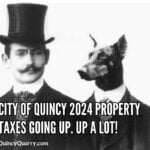

After Quincy Quarry News’ successfully projecting 2024’s 8.3% average residential property tax increase slapped on Quincy homeowners — an increase half again to leaning on twice as much more than the increases in many to most other Massachusetts municipalities — to within but a few tenths of a percentage point months before of the Calendar Year 2024 residential property tax increase was officially set last December. Quincy Quarry is again venturing to project next year’s residential property tax increase.

Then again, setting the 2024 residential property tax rates after last year’s election and so covering Quincy Mayor THomas P. Koch’s tuchus was surely but a coincidence.

Also surely a concurrent coincidence was so papering over the fact of Mayor Koch’s duly calculated actual 10% Fiscal Year 2024 budget spending increase.

In any event, the quants on Quincy Quarry’s financial and taxation desk have finally completed running the numbers from Quincy Mayor Thomas P. Koch’s Fiscal Year 2025 budget so as to endeavor to suss out the bad news for homeowners come the fast approaching new calendar year tax year.

After all, such is necessary as the Koch Maladministration has yet again failed to project expected residential property tax bill increases and so only properly help locals to prepare — if not also warn — local homeowners of their impending financial pain come the new year and thus again the Quarry has stepped up to the plate.

It was especially tricky for Quincy Quarry News’ crack team of quants on crack to run the numbers for the upcoming 2025 tax year.

Why so?

On top of the usual koch and mirrors rife with Mayor Koch’s annual City of Quincy budgets — for example for years Mayor Koch’s budgets do not note actual full year spending data, the Quarry’s quants only had the proposed FY 2025 budget to work with as opposed to the approved FY 2025 budget.

Granted, the rubber stampers on the Quincy City Council pretty much approved all of the line item asks in the mayor’s proposed Fiscal Year budget; even so, no access to the actual numbers is inexcusable.

Further, other important data are also MIA.

For example, the Koch Maladministration habitually fails to pose expected “New Growth” property tax revenue until property tax rates are set even though the maladministration has ample data to project New Growth as well as surely does so for internal consideration and uses.

The Koch Machine is also habitually slow to disclose the expected “Free Cash” balance of greater than expected revenue plus unspent budgeted funds and so have the means to moderate property tax increases.

Then again, the Koch machine has failed to see the Free Cash number certified in time for setting property tax rates in December for the upcoming year even though it has retained an outside vendor to help see Free Cash certified by the Massachusetts Department of Revenue.

Further problematic, data on what certain favored property taxpayers are scoring tax breaks are all but impossible to find.

Accordingly, the sum of it all behooves Quincy Quarry to project a wider and thus less certain projection for 2025 residential property tax increases even if the Quarry’s margin of error is still significantly narrower than was the case with this year’s election polls.

While a lower increase than this year’s over 8% increase, such somewhat good news will be followed by bad news.

Then again, suspect investment management, koched-up pay raises care of obscene raises late in favored employees’ careers so as to pop their pension checks, and even cyberheisting do take their tolls.

It feels like property taxes keep going up without much transparency on where the funds are going. While I understand the need for city improvements, I hope the additional revenue will truly benefit the Quincy community and not just go toward administrative costs. Does anyone know more details about the specific projects or services that will be funded by this increase? I’d love to see clearer communication from city officials so residents can better understand how this impacts us and how we’ll see the improvements.

Kelly,

Ya, right … https://tenor.com/view/laugh-slam-gif-24277663

Never gonna happen as long as Mayor Kook stays as Mayor, just like the AUDIT that was voted for by the people ain’t gonna happen! 🤡

Payroll expenses,which is the towns largest expense, only went up 3% a year based on contract negotiations, except for Koch and the council. Where is the extra money going? We certainly aren’t getting more services. If anything we are getting less. Only favored big developers are seeing a tax breaks.

Transparency,

Quick and oh so dirty, metastasizing growth in debt including a roughly 50% increase in debt service expense on the horizon for FY 2026.

Their growth projections must be off. New developments were supposed to provide increased tax revenue to cover the debt service increases incurred to cover the nut for all the new infrastructure in Quincy Center. Also, what do you think the eminent domain purchases like the IHOP will end up costing local taxpayers?

We find it odd to be asked to make an ‘appointment’ for the assessors to come by in our neighborhood,instead of the usual drive by valuations. And to urge homeowners to allow the assessors inside (although not required) just smells funny.

Mayor Koch and our City Councilors have a plan to reduce expenses. Purchase more property by eminent domain at a “reasonable” price and then sell it soon after acquiring it to a developer at a much lower “reasonable” price.

Developers get deals like new stop lights, landscaped traffic islands, etc. The $135,000 raise for Mayor Koch and lesser raises for city councillors is another issue. Live on or have a view of the water — recall the 2004 tax scam called a view tax. So much also for fixing local roads or at least filling potholes. In the meanwhile, my property tax bill went up 20%/$1,000 a year.