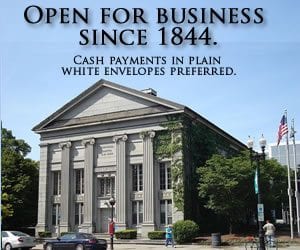

– Quincy News from Quincy Quarry News with commentary added.

Quincy 2021 property tax bills are yet again fraught with City Hall games.

In turn, at least locally, December 7 is yet again a day that will live in infamy.

Last spring Quincy Mayor Tom Koch presented a so-called level services budget in response to the COVID-19 pandemic and said he was not planning to impose a property tax increase on homeowners come 2021.

It will all be OK, trust me, drink the Koch-Aid, etc.

A Facebook photo

The City Council believed him and then approved his proposed budget.

Instead, however, he has since come back for over $12 million in additional funding after cutting city spending by over $5 million on top of $2 million appropriated last year but not spent and already these cuts are showing via – for but one example – even more unfilled potholes than usual.

To cover his spending nut, Koch is tapping several of the city’s thin reserves accounts by a total of $8.2 million on top of imposing a roughly $6 million property tax increase and over $7 million in spending cuts, so totaling close up to $20 million if one is duly following the money to cover a budget that originally proposed a but a $10 million spending increase.

Crushed property taxpayer

Click on image to see better image – software glitch

An O’Mahoney/Patriot Ledger image

To the purported need to score $20 million to cover a but $10 million original budget spending increase, Koch Maladministration spokesmodel Pinocchio Walkbacker foisted an especially amusing explanation, including that the maladministration expects that anticipated state and federal funds will allow the city to perhaps then replenish some of the to be depleted city reserve funds to cover various expected shortfalls in the meanwhile.

So what if such funding is still tied up in congressional infighting as well as that in particular Senate Majority Leader Mitch McConnell has made it very clear that he will not allow the appropriation of federal funding to bail out mostly Northeastern states and cities that were financially strapped long before the COVID-19 pandemic hit the fan.

In turn, Quincy surely fits the profile of financially troubled.

For example, to fund his 2021 budget, Mayor Koch sought and has secured the withdrawal of $4.2 million from the city’s Stabilization (“Rainy Day”) Fund.

Granted, it is clearly raining COVID-19; however, it still must be noted that before this withdrawal, Quincy’s Rainy Day Fund was at best roughly half of what best practices recommend.

Additionally, just a couple weeks ago the city’s outside bond counsel testified before the City Council that the city should be increasing this reserve fund.

Instead, Mayor Koch will be draining this already inadequate reserve fund down to less than a third of what is considered to be fiduciarily responsible.

The mayor also tapped $2 million of the but $3.1 million City of Quincy’s Other Post Employment Benefits reserve fund.

This employee benefit is underfunded by upwards of half a billion dollars or more, depending on how one cares to calculate this local taxpayer-guaranteed entitlement. In turn, this all but unfunded retirement benefit expense currently requires a roughly $11 million expense in the city budget on an expense item that should more prudently be pre-funded on a actuarial basis a la a pension fund.

Also problematic, the city employee pension fund is similarly as well as woefully underfunded.

How woefully?

Up in smoke …

A cheatsheet.com image

For but starters, local taxpayers have to fund a currently $32 million annual makeup payment – roughly 10% of the city’s annual budget spending – to prop up a pension fund that is supposed to be self-funded by employee paycheck deductions.

Even more troubling, this annual financial obligation is growing both in amount and in terms of the percentage of the city’s annual spending.

Further problematic, the state pension board is insisting upon significantly increasing the currently already scheduled ever-increasing annual pension shortfall make-up payments starting in Fiscal Year 2022 come next July, payments which have already been increasing by over several times the annual rate of inflation for roughly a decade and will likely continue to do so for at least a couple more decades while also so becoming an even greater percentage share of the annual city budget.

While Koch Maladministration would likely opt to offload the blame for the CIty of Quincy’s among the worst off municipal pension system in the Commonwealth – and which is also even worse off than the MBTA’s, essentially all of the key reasons that this dire sword of Damocles is hanging over local taxpayers are the maladministration’s fault given that facts are stubborn things.

The reality of this one of at least several financial time bombs facing local taxpayers was ultimately set in place by a past ill-advised decision of the maladministration to spread out the pension make-up payments over decades as well as paying the minimum balance.

Additionally, the Koched-up pension board has since been less than aces with its portfolio management strategies during what has arguably been the most robust bull market in the history of Wall Street.

Scrounging for spare change in Kim Jong Koch Plaza’s water foundations?

A Quincy Quarry News file photo

Returning to the funding of Koch Maladministration spending in 2021, even after scrounging for spare change most everywhere imaginable as well as often problematically so notwithstanding, local homeowners are still looking at a several percent property tax increase come the first of year as opposed to the mayor’s announced goal last spring to strive for no increase.

Needless to say, “goal” is a great catchword for politicians and especially for profligate ones.

Further problematic, Koch’s plan for covering the nut in 2021 also variously pushes all sorts of costs onto future budgets.

For example, how his draining of city reserves will likely result in the downgrading of Quincy’s credit rating just as his already in the works massive bond debt encumbrances start hitting the fan and so probably further increasing already worrisome debt service costs.

Additionally, Quincy’s long ongoing structural deficit status budgets are going to face even greater shortfalls going forward for various other reasons also at least exacerbated by the Koch Maladministration.

For example, other highly leveraged Koch Maladministration’s plans have put local taxpayers at even greater risk in the future as this year’s considerable tapping of already woefully thin city reserves which it has failed to duly see funded to appropriate levels given these various additional koched up risks so undertaken will leave precious little in the way of reserves remaining to weather future economic travails.

For but starters, already there is little doubt that the financial impacts of the COVID-19 pandemic will linger for at least a while after the virus itself might be abate given sufficient vaccination rates worldwide.

In the meanwhile, however, Quincy Mayor Tom Koch will surely continue to state that he could tax locals even more while ignoring that a local anomaly as regards Prop 2 1/2 has long resulted in Quincy homeowners paying higher property tax bills than many peer communities per identical assessed value bases.

In other words, legerdemain.

.

And yes, at some point probably soon as reserves are depleted, Quincy property taxpayers can all but count on finding themselves taxed at somewhere at least close to the local Prop 2 1/2 max, especially given what all the Koch Maladministration has long also all but invariably done to push paying off many of the bills to pay for its problematic financial practices down the road.

That and further given a variety of impending balloon payments the maladministration has obligated local taxpayers to underwrite and which come due in coming years even though so far woefully little in the way of needed local new development has happened to cover these unavoidable nine-figure bills.

Soon coming years, repeatedly as well as sure to be painfully so for local taxpayers.

In turn, the local property tax levy could so end up increased by upwards of as much as 15% before hitting the local Prop 2 1/2 property tax limit.

In turn, such would push local residential property taxes from currently higher than state residential property tax bill averages to among the highest in the Commonwealth no matter how the Koch Maladministration might care to either compare or spin things vis-a-vis the property tax bills in other communities.