– Quincy news from Quincy Quarry News

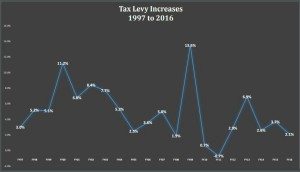

Huge 2009 increase with even more later hits hit harder than gradual increases over time. A City of Quincy graphic.

Click on image to better see this graph

Koch Maladministration errantly acknowledges its massive property tax hikes.

The Koch Maladministration’s latest Annual Tax Rate and Financial Report errantly as well as finally noted the maladministration’s massive 13.5% local property tax hike in 2009.

This increase far outstripped most other Massachusetts municipalities tax hikes that year as these other communities instead prudently hunkered down for the duration of the Crash of 2008.

For reasons never acknowledged but easy surmised, the Koch Maladministration has long failed to note its massive 2009 property tax increase heretofore in any of the many overspun PowerPoint presentations that it has long used to confuse variously as well as long-abused local property tax taxpayers.

Regardless, now surely errantly inclusive of the 2009 local property tax increase data, the Koch Maladministration is now finally documenting the fact that it has increased the local residential property tax take total by 36.2% since coming into office as well as concurrently increased the local commercial property tax take by 32.1%.

In turn, these property tax increases thus ran roughly three times the rate of inflation over the same eight-year period.

Inclusive of the fact that the massive 13.5% 2009 tax increase was on the front end of the tax increases over the past eight years, such only further whacked local property owners hard as their property tax bill increases were thus front-loaded and so increased the total dollar amount of property taxes they have had to pay over the eight-year period.

Next, while total city spending went up by 29.5% over the same time period, the distribution of the increase was lopsided.

For example, school spending, roughly 35% of the annual budget, has only seen annual increases in its annual appropriation over the past eight years as but essentially matching the rate of inflation.

Further problematic for local public schools, during this same timeframe state aid to schools has flagged while local enrollment has increased by roughly five percent over the same timeframe.

As such, annual spending per student has declined by roughly the same percentage as the enrollment increase after duly adjusting for the impact of inflation.

Conversely, city spending in all other areas has thus increased by well over a third and – again – roughly three times the rate of inflation.

In spite of this massive taxing and spending, the FY 2016 Annual Tax Rate and Financial Report continues to make much about how the Koch Maladministration could have increased local property taxes by another 11% – or roughly another $23.5 million more.

The problem with this argument is that through a set of quirks as to how local Prop 2 1/2 limits play out over time, Quincy can tax its total local assessed value by as much as 1.87% before hitting the local Prop 2 1/2 limit and will be taxing local property in 2016 at 1.68% of its total assessed value.

By contrast, Braintree can only tax up to a rate of 1.4% of its total local property assessed value in 2016.

As such, Quincy is thus currently taxing its local assessed value by 20% more than is Braintree as well as could tax local property in Quincy by as much as 33.6% more than Braintree before Quincy would hit its local Prop 2 1/2 maximum.

Further, per a reasonable sample of other comparable Commonwealth peer communities to Quincy, its percentage rate of taxing the assessed value of its local property is similarly higher than many of these peer communities as well as that Quincy’s assessed value percentage tax hit looks to be greater than the aggregate average of these peer communities.

In other words, if local homeowners feel that their property tax bills are high as compared to other most communities, they are when compared to other communities per properly adjusted local single family residences’ average assessed values.

Finally, while the Koch Maladministration has as well as surely will continue to try to spin things differently, the fact of the matter is that its tax and spending increases have been both considerable as well as generally increasing at rates more than both those in peer communities as well as per state averages.

QuincyQuarry.com

Quincy News, news about Quincy, MA - Breaking News - Opinion

No more posts